Expenses are used in Ascora to record and track miscellaneous costs associated with a Job that aren’t typically on-charged to a Customer. Examples could include parking or meal expenses.

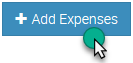

1. To add an Expense to a Job, choose the Supplies Tab on the Job Details and scroll down the screen to the Expenses section. Click the +Add Expenses button.

2. The New Expense pop-up window will display, allowing you to record the details on the Expense:

- Select a Supplier from the dropdown list

- If you have integrated Ascora with your accounting package, an Expense Account dropdown list will display all Expense or Cost of Goods sold Accounts that exist in your chart of accounts.

- Enter the Invoice Number for the expense

- Select the Invoice and Due dates

- You can optionally choose to attach a file – for example, a photo of a parking receipt (Note: If you are integrated with Xero, Ascora will automatically push this attachment across as well).

- Click in the Description box to type a description for the Expense

- Click in the Quantity box to enter a quantity for the Expense

- Enter a Unit or Total Cost (inclusive or exclusive of tax)

- When you are ready, click the Save button

Note: If you have linked Ascora with your Accounting Package, when you click Save, Ascora will automatically push expense across to your Accounting System as a Supplier Invoice / Bill.

The Financial Summary on the Job Details will display the Total of all Job Expenses along with Labour and Material Costs so you can see in real-time how your Job's are tracking.

5 Comments

Anonymous

Can you add an expense without pushing it through to Xero? For example, it's already processed in Xero, but want to capture the expense just in Ascora.

Ascora Support

Hi. It's not possible if using Accounts Integration as so you would need to just manually delete the version that is created in Xero.

Anonymous

What if these expenses are on-charged to customers (but are not materials). Such as parking etc which we do on-charge.

How do you get these expenses to appear in the reporting of the job? Is there a status or something to select?

Clearly aren't materials so don't want to add it it in there. Just having the choice between including to on charge and appear in reports or not would be great.

Ascora Support

Hi, Any expenses which are on-charged to customers will need to be entered into the supplies table.

Anonymous

Hi Ascora,

Is it possible to convert a supplier invoice into an expense?

I am fetching expense claims through the Ezzybills integration, so they are appearing as Supplier Invoices, however I want them to as Total Expense Costs and not to populate into the supplies table

Add Comment